In the year 2023, the world was shaken by the news of the collapse of Silicon Valley Bank. The bank, which had been a mainstay of the technology and life science industries for a long time, had encountered mounting financial difficulties due to a series of bad loans and risky investments. Although Silicon Valley Bank attempted to strengthen its finances, it was unable to halt the increasing losses and eventually became insolvent, leading to its takeover by the FDIC.

The collapse of Silicon Valley Bank had a profound impact on the financial industry. As a major player in the technology and life science sectors, the bank’s downfall sent shockwaves through these industries. Many companies suddenly found themselves without access to the financing and banking services they relied on to fuel their growth. The loss of this vital support threatened to stifle innovation and development, potentially having long-term implications for the global economy.

The Financial Crisis of 2008

The 2008 financial crash was a significant global crisis that shook the entire financial industry, resulting in the collapse of several large banks, massive job losses, and a recession that affected multiple countries. The crisis began in the US and was caused by a combination of factors, including poor regulation, excessive risk-taking, and the collapse of the housing market. In this blog, we will discuss the events that led up to the banking crash of 2008, the consequences of it, and the lessons that we can learn from it.

The Roots of the Crisis

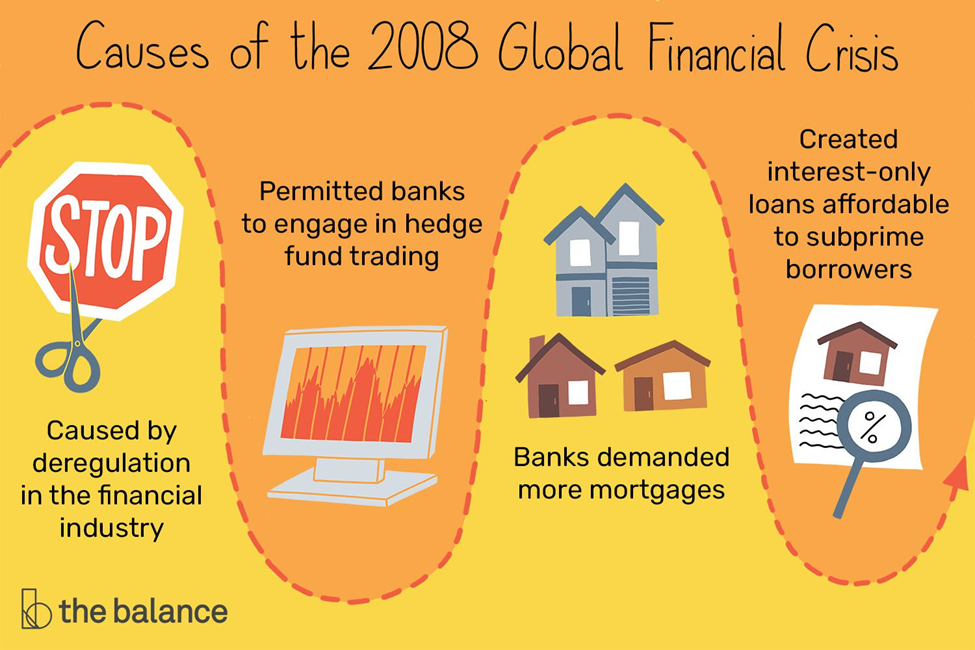

The roots of the crisis can be traced back to the early 2000s when the US housing market began to boom. Lenders, eager to make profits, started issuing subprime mortgages to people with poor credit ratings. These loans were bundled together and sold as mortgage-backed securities (MBSs) to investors worldwide. The problem was that the value of these securities was based on the assumption that the housing market would continue to rise indefinitely. When the housing market collapsed in 2007, the value of the securities plummeted, leading to significant losses for investors.

Another contributing factor was the deregulation of the financial industry that started in the 1980s. Banks and other financial institutions were permitted to engage in risky investment practices, such as trading in derivatives and other complex financial instruments, without proper oversight or regulation. This led to a situation where banks took on too much risk, and when the crisis hit, they were unable to absorb the losses.

The Consequences

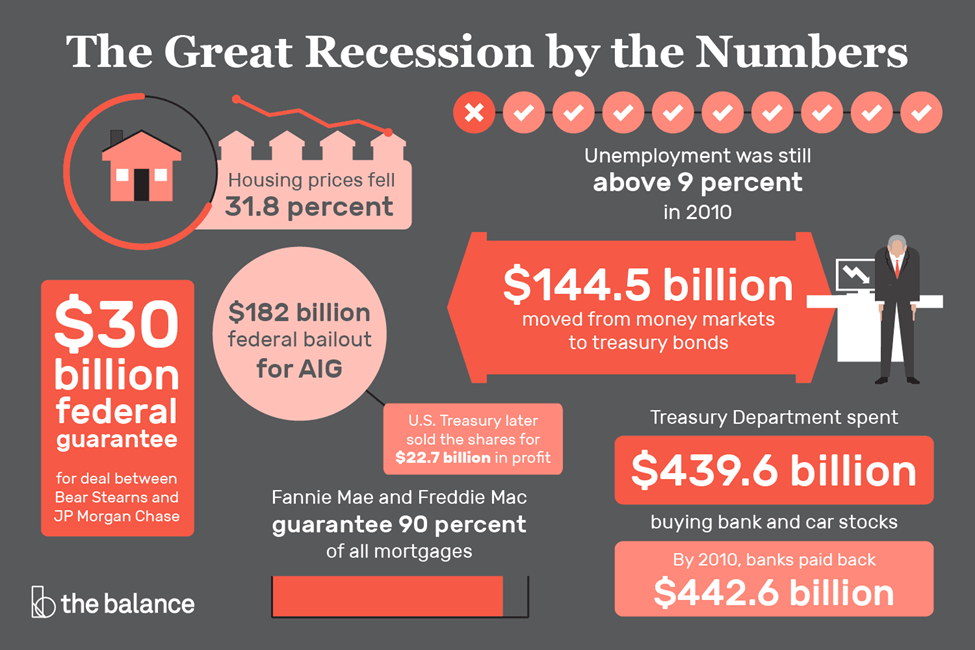

The financial crash of 2008 had far-reaching consequences that were felt worldwide. Many of the world’s largest banks, including Lehman Brothers, Bear Stearns, and Merrill Lynch, collapsed or were forced to merge with other institutions. In the US alone, more than 500 banks failed, leading to massive job losses and a deep recession. The crisis also had a significant impact on other countries, especially those that had heavily invested in the US housing market.

Governments worldwide had to take swift action to prevent a complete collapse of the financial system. Central banks lowered interest rates and injected massive amounts of liquidity into the markets, while governments passed stimulus packages to keep the economy afloat. The crisis also resulted in a global recession that lasted for several years, with many countries struggling to recover.

Lessons Learned

The banking crash of 2008 was a wake-up call for the financial industry and policymakers worldwide. It highlighted the need for better regulation and oversight of the financial system to prevent excessive risk-taking and the accumulation of systemic risk. Several regulatory reforms were implemented after the crisis, including the Dodd-Frank Wall Street Reform and Consumer Protection Act in the US and the Basel III accord internationally. These reforms aimed to increase transparency and accountability in the financial industry, as well as to reduce the likelihood of another crisis.

The crisis also emphasized the importance of risk management in the financial industry. Banks and other financial institutions need to have robust risk management processes in place to identify, assess, and manage risks effectively. This includes stress testing and scenario analysis to evaluate the impact of adverse market conditions on their portfolios.

Another lesson from the crisis is the significance of avoiding conflicts of interest in the financial industry. Banks and other financial institutions need to maintain a clear separation between their trading and investment activities and their other businesses, such as retail banking. This will help prevent situations where banks take on excessive risk to generate profits, at the expense of their customers and the wider economy.

The Present

Coming back to the present, the collapse of Silicon Valley Bank is a stark reminder of the risks inherent in the financial industry, and of the importance of maintaining vigilance and oversight to prevent another global financial crisis. But by applying the lessons learned from the past, hopefully the industry will be able to weather the storm and emerge stronger and more resilient than ever before.

Written by: Rtr. Lakshan Banneheke

Edited by: Rtr. Imesha Ilangasinghe